Contents:

https://1investing.in/es with accurate cost measurement know whether they are making a profit on current goods and know how to judge potential investments, new products or other opportunities. Using the correct costing method for the opportunity is a primary focus of effective cost accounting and financial control. Incremental and marginal costs are two of the primary tools to evaluate future investment or production opportunities.

Undervalued Communication Services Stocks – Morningstar

Undervalued Communication Services Stocks.

Posted: Thu, 13 Apr 2023 17:23:01 GMT [source]

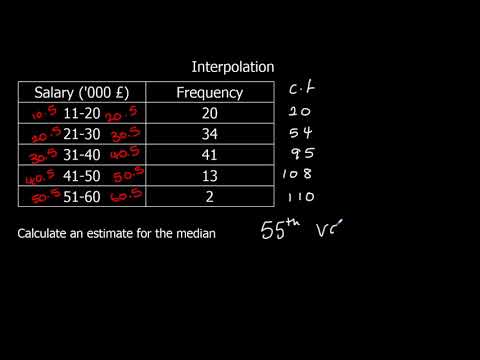

As a result, the total incremental cost to produce the additional 2,000 units is $30,000 or ($330,000 – $300,000). Diseconomies Of ScaleDiseconomies of scale is a state that generally occurs when an enterprise expands in size. The average operating cost increases due to inefficiency in the system, employee incoordination, administration & management issues, and delayed decisions. Incremental cost analysis considers only relevant costs directly linked to a business unit when evaluating the profitability of that business unit. Analyzing and understanding incremental cost enable companies to improve production efficiency. Sunk costs are historical costs which cannot be changed no matter what future action is taken.

Associated Content

Furthermore, fixed costs can be difficult to allocate to a certain business area. The calculation of incremental cost shows a change in costs as production expands. Marginal cost is the cost to produce one additional unit of production. It is an important concept in cost accounting as marginal cost helps determine the most efficient level of production for a manufacturing process. It is calculated by determining what expenses are incurred if only one additional unit is manufactured.

Surgery, a Cost-Effective Treatment for Adults With Drug-Resistant … – Neurology Advisor

Surgery, a Cost-Effective Treatment for Adults With Drug-Resistant ….

Posted: Thu, 13 Apr 2023 14:34:00 GMT [source]

Normal production is 5,000 units at a total cost of $500,000. Analysis of the cost data shows that adding another 500 units will increase total cost to $530,000. Divide $30,000 by 500 and you have an incremental cost of $60 per unit.

They can include the price of crude oil, electricity, any essential raw material, etc. Incremental cost is the additional cost incurred by a company if it produces one extra unit of output. The additional cost comprises relevant costs that only change in line with the decision to produce extra units. An incremental cost effectiveness ratio is an economic measurement used to study business alternatives which have both separate costs and separate outcomes.

What is the meaning of variable cost?

Businesses may experience lower costs of producing more goods if they have what are known as economies of scale. For a business with economies of scale, producing each additional unit becomes cheaper and the company is incentivized to reach the point where marginal revenue equals marginal cost. It can be of interest to determine the incremental change in cost in a number of situations. For example, the incremental cost of an employee’s termination includes the cost of additional benefits given to the person as a result of the termination, such as the cost of career counseling. Or, the incremental cost of shutting down a production line includes the costs to lay off employees, sell unnecessary equipment, and convert the facility to some other use. As a third example, the sale of a subsidiary includes the legal costs of the sale.

That conclusion is consistent with the notion of amortizing an asset over its useful life and with other standards. In that case, the acquisition costs from the initial contract do not relate to the subsequent contract. The incremental total is always made up of purely variable costs. It represents the added costs that would not exist if the extra unit was not made. That means that many fixed costs such as rent on a factory or buying a machine are not usually represented.

Site and content preferences

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. To determine the changes in quantity, the number of goods made in the first production run is deducted from the volume of output made in the following production run. However, there are minor distinctions between the two conceptions. Marginal analysis is an examination of the additional benefits of an activity when compared with the additional costs of that activity. Companies use marginal analysis as to help them maximize their potential profits.

The company wants to add another product, ‘Y,’ for which it incurs some cost in terms of salary to the additional labor force, raw materials, and assuming that there was no machinery, equipment, etc., added. Incremental cost analysis, together with the analysis of production volumes, helps companies attain economies of scale by optimizing production. Economies of scale occur when the average cost per unit declines as production increases. Incremental cost is usually computed by manufacturing entities as a process in short-term decision-making.

Other Topics require some of the costs of obtaining a contract to be included in the carrying amount of an asset on initial recognition. The revenue target is impacted by more than obtaining new contracts. As such, the payment would not be an incremental cost to obtain the contract. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

The commission is a cost to obtain a contract that would not have been incurred had the contract not been obtained. Since ProductCo expects to recover this cost, it can recognize the cost as an asset and amortize it as revenue is recognized during the year. The commission payment can also be expensed as incurred because the amortization period of the asset is one year or less. The revenue standard does not address the timing for recognizing a liability for costs to obtain a contract.

Incremental Revenue vs. Incremental Cost

If the LRIC rises, it is likely that a corporation will boost product pricing to meet the costs; the inverse is also true. Forecast LRIC is visible on the income statement, where revenues, cost of goods sold, and operational expenses will be altered, affecting the company’s total long-term profitability. You calculate your incremental revenue by multiplying the number of smartphone units by the selling price per smartphone unit. You calculate your incremental cost by multiplying the number of smartphone units by the production cost per smartphone unit.

- The incremental cost is computed by examining the additional expenses incurred during the manufacturing process, such as raw materials, for each additional unit of output.

- If the price offered by the customer is at least this much, management should accept the order.

- For more learning, CFI offers a wide range of courses on financial analysis, as well asaccounting, and financial modeling, which includes examples of the marginal cost equation in action.

This can especially be seen in places still considered part of the “developing” world, where many of the jobs have been outsourced from the West. Yes, if the costs to obtain contract renewals or modification are incremental and recoverable. An example is a commission paid to a sales agent when a customer renews a contract. Management should not, however, record an asset in anticipation of contract renewals or modifications if the reporting entity has not yet incurred a liability related to the costs.

Start free ReadyRatios reporting tool now!

Understanding incremental cost can help you decide whether to develop a product or just purchase it from another supplier. You may estimate how much you should budget for your firm and how much profit you might make by conducting this type of cost analysis ahead of time. So, you can then assess whether or not it makes business sense to expand operations. Break-even analysis calculates a margin of safety where an asset price, or a firm’s revenues, can fall and still stay above the break-even point. This allocation can even change in the future course of business of ABC Ltd. when supposedly, if it chooses to drop product ‘X,’ then product ‘Y’ or any other product might become the primary user of the cost.

Incremental cost is the amount of money it would cost a company to make an additional unit of product. Due to economies of scale, it might cost less in producing two items than what was incurred in producing each one separately. Let us assume that it costs 950 for producing two items simultaneously. The basic method of allocation of incremental cost is to assign a primary user and the additional or incremental user of the total cost.

Analyzing production volumes and incremental costs can assist businesses in achieving economies of scale in order to optimize production. Economies of scale occur when expanding production results in cheaper costs because the costs are spread out over a greater number of commodities produced. In other words, when output increases, the average cost per unit decreases. When incremental costs are added, the fixed costs normally do not change, implying that the cost of the equipment does not vary with production levels. Marginal cost is the change in total cost as a result of producing one additional unit of output.

Also called the 501c3 meaning cost approach, marginal analysis, or differential analysis, incremental analysis disregards any sunk cost or past cost. Target profit is $100,000; total fixed costs are $120,000, and total variable costs are $500,000, the markup percentage is %. The Boards considered requiring an entity to recognize all of the costs of obtaining a contract as expenses when those costs are incurred. The Boards observed that, conceptually, an entity may obtain a contract asset as a result of its efforts to obtain a contract .

Begin by entering the starting number of units produced and the total cost, then enter the future number of units produced and their total cost. A variable cost is a corporate expense that varies in relation to the amount of product or service produced or sold. Variable costs rise or fall in relation to a company’s production or sales volume, rising as production increases and falling as production drops. This is an example to further appreciate the distinction between incremental cost and incremental revenue. Imagine you own a smartphone manufacturing company that expects to sell 20,000 devices. Each smartphone costs you $100 to produce, and your selling price each smartphone is $300.

Thus, incremental cost is a product of an increase in production. It is usually made up of variable costs, which change in line with the volume of production. Incremental cost includes raw material inputs, direct labor cost for factory workers, and other variable overheads, such as power/energy and water usage cost. In the staff’s view, View C is the appropriate application of the new revenue standard. The new revenue standard defines incremental costs as those that an entity incurs in its efforts to obtain a contract and those that would not have been incurred if the contract had not been obtained. The new revenue standard does not make a differentiation based on the function or title of the employee that receives the commission.